franklin county ohio sales tax on cars

The Franklin sales tax rate is. Franklin county ohio sales tax on cars.

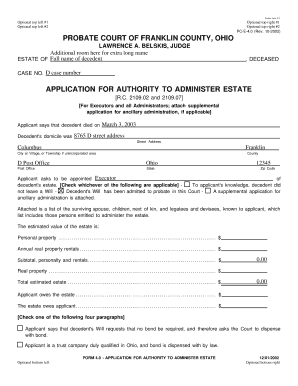

Step By Step Guide To The Franklin County Probate Process Columbus Real Estate

Has impacted many state nexus laws and.

. Or visit our Ohio sales tax calculator to lookup local rates by zip code. Please make checks payable to. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales.

Can I transfer a title for another person if they are unable to come to your office. Ad Use the Kelley Blue Book Price Advisor and Find Great Car Prices. Auto repairs are regulated by Ohios Auto Repairs and Services Law.

The Ohio state sales tax rate is currently. Wayfair Inc affect Ohio. If you have questions contact the Ohio Attorney Generals Office at 800 282-0515 or 614 466-4320.

Its important to note this does not include any local or county sales tax which can go up to 225 for a total sales tax rate of 8. Sales tax is required to be paid when you purchase a motor vehicle or watercraft. This includes the rates on the state county city and special levels.

What is the sales tax on cars in Franklin County Ohio. Franklin Countys is 75. The Franklin County sales tax rate is.

May 11 2020 TAX. The base state sales tax rate in Ohio is 575. Franklin Countys is 75.

How Much Is the Car Sales Tax in Ohio. The minimum combined 2022 sales tax rate for Franklin Ohio is. How to Calculate Ohio Sales Tax on a Car.

Franklin County OH Sales Tax Rate The current total local sales tax rate in Franklin County OH is 7500. Taxes are due on a vehicle even when the vehicle is not in use. The December 2020 total local sales tax rate was also 7500.

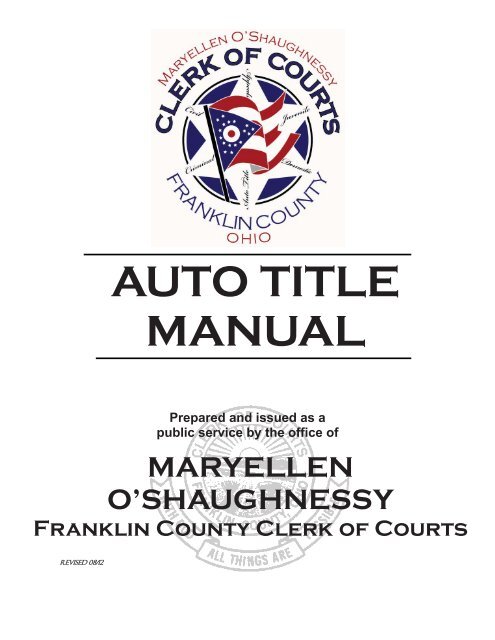

There are also county taxes that can be as high as 2. Franklin County Clerk of Courts. Franklin County Sales Tax Rates for 2022.

2022 Ohio Sales Tax By County Ohio has 1424. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled. Our office is open Monday through Friday 800 am.

Ohio collects a 575 state sales tax rate on the purchase of all vehicles. This is the total of state and county sales tax rates. Your tax rate depends on your county of residence.

You may obtain county sales tax rates through the Ohio Department of Taxation. Franklin County Ohio Sales Tax Rate 2022 Up to 775 The Franklin County Sales Tax is 125 A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax. The 2018 United States Supreme Court decision in South Dakota v.

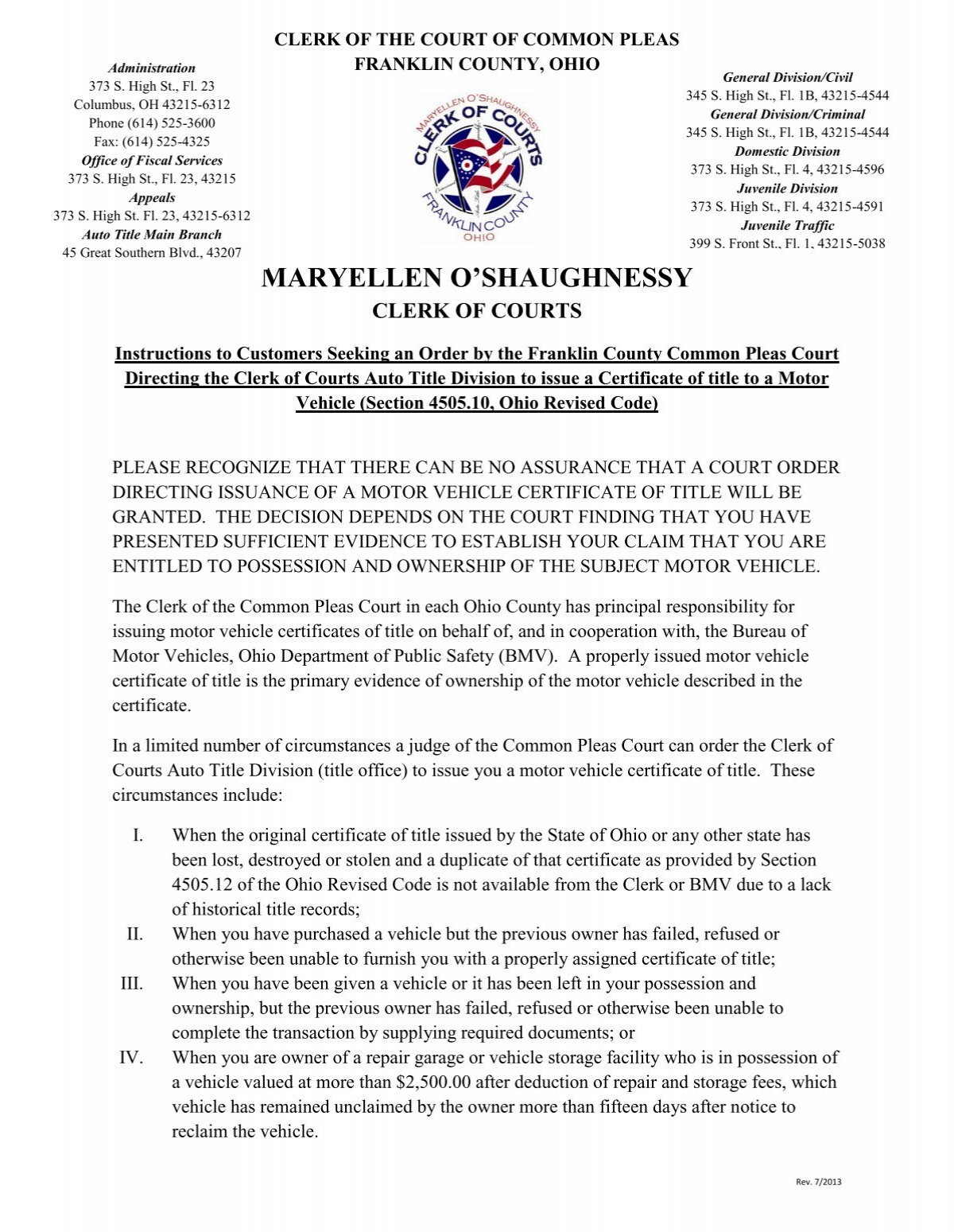

Franklin county ohio sales tax on cars. Below are some examples of what parts of certain auto repairs are taxable. 1500 title fee plus sales tax on purchase price add 100 fee per notarization andor 150 for out-of- state transfers.

In addition to taxes car purchases in Ohio may be subject to other fees like registration title and plate fees. However the average total tax rate in Ohio is 7223. The Ohio sales tax rate is currently.

The properties in community reinvestment areas in franklin county had an abated value of more than 42 billionwith about 111 million in taxes that werent collected under agreements with local. Additional evidence may be required based on unique titling situations. Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8.

Information can also be found online at wwwohioattorneygeneralgov. Some cities and local governments in Franklin County collect additional local sales taxes which can be as high as 075. The minimum combined 2022 sales tax rate for Franklin Ohio is.

The 2018 United States Supreme Court decision in South Dakota v. Get rates tables What is the sales tax rate in Franklin Ohio. Did South Dakota v.

17TH FLOOR COLUMBUS OH 43215-6306. Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County totaling 175. The County sales tax rate is.

You may obtain county sales tax rates through the Ohio Department of Taxation. You can find more tax rates and allowances for Franklin County and Ohio in the 2022 Ohio Tax Tables. We accept cash check or credit card payments with a 3 fee.

The current sales tax on car sales in Ohio is 575. Some dealerships may also charge a 199 dollar documentary service fee. Determine Monthly Payment Trade-In Value And More Before Going To The Dealer.

1500 title fee plus sales tax on. What county in Ohio has the lowest sales tax. If you need access to a database of all Ohio local sales tax rates visit the sales tax data page.

This is the total of state county and city sales tax rates.

Demographics Franklin County Ohio

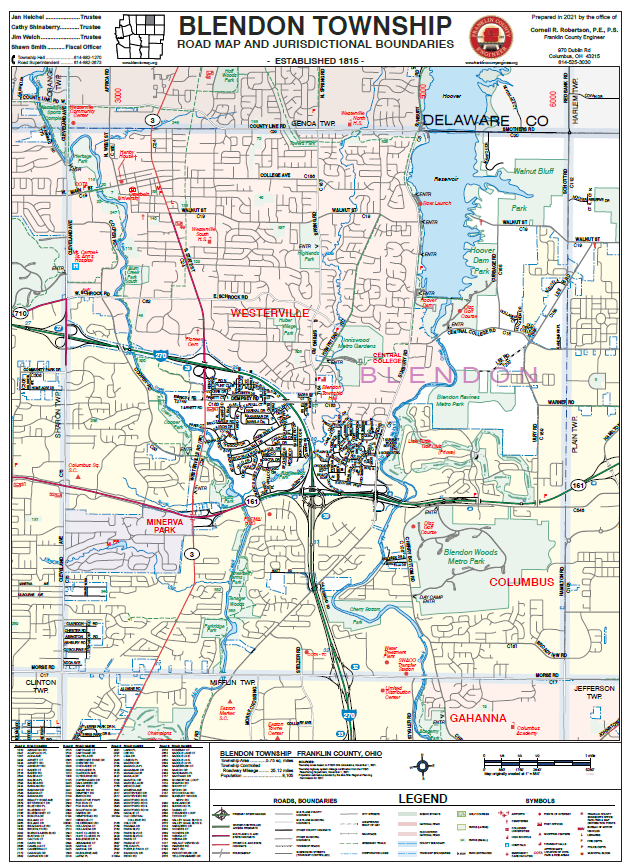

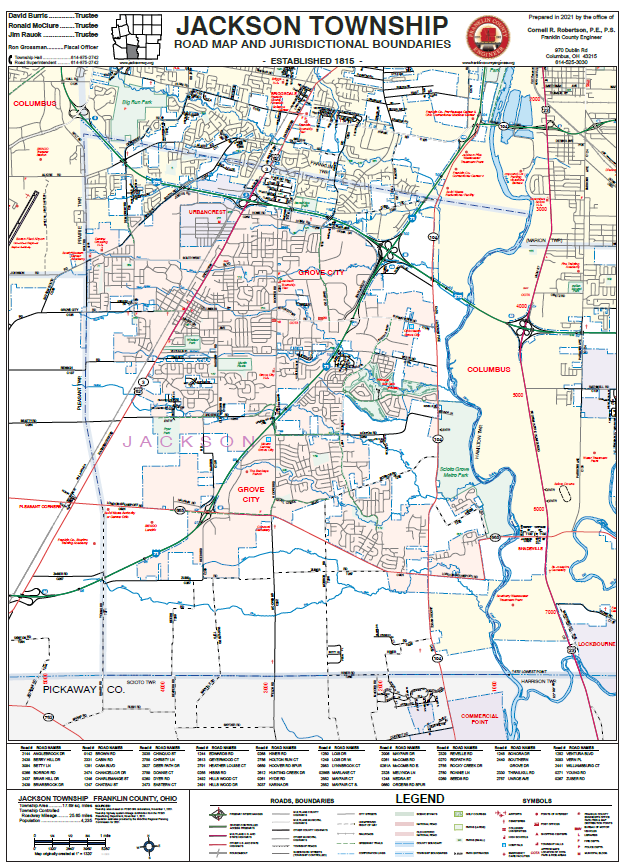

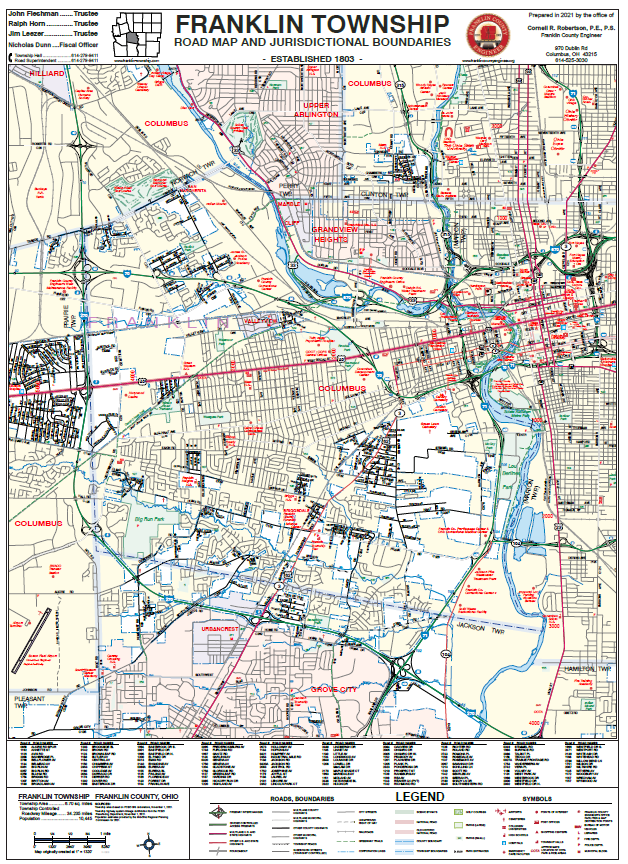

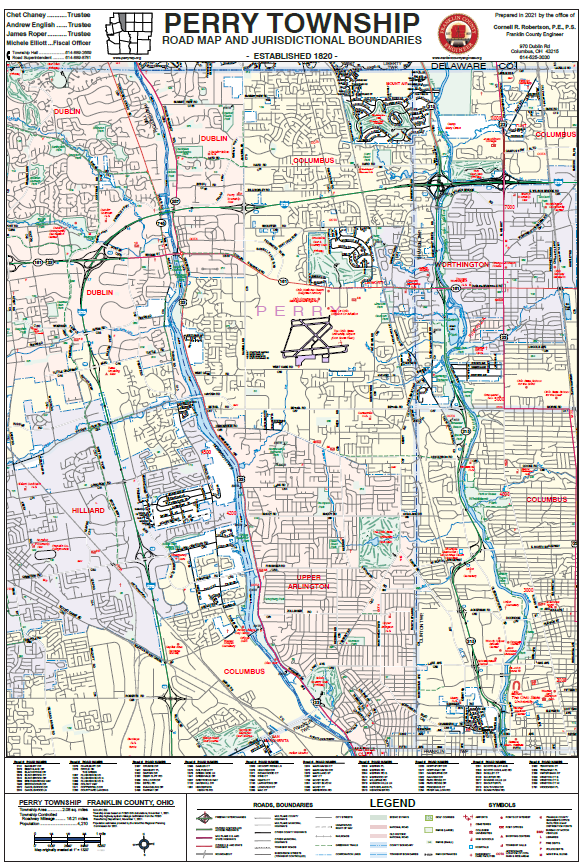

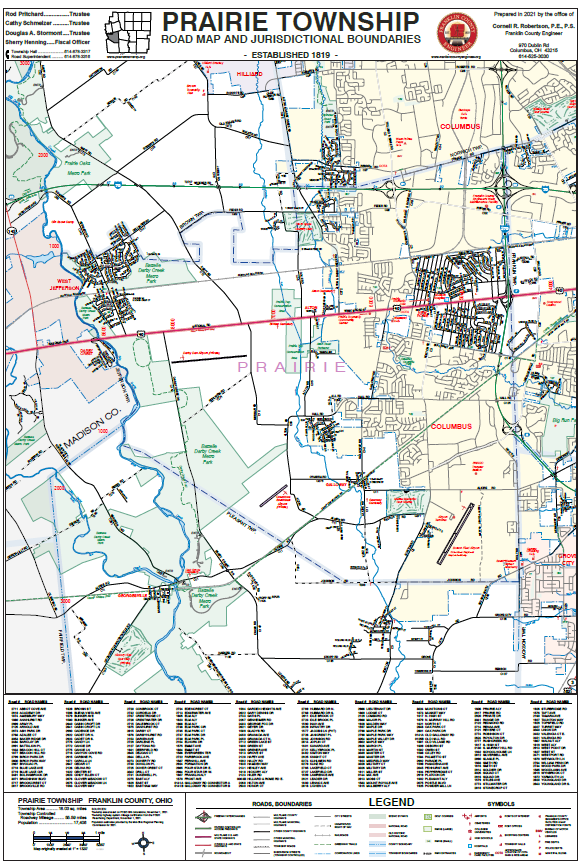

Township Maps Franklin County Engineer S Office

Franklin County Treasurer Home

Township Maps Franklin County Engineer S Office

Franklin County Auditor Licensing Types

Township Maps Franklin County Engineer S Office

Franklin County Treasurer Home

Township Maps Franklin County Engineer S Office

Fillable Online Franklin County Probate Court Application To Administer Estate Form Fax Email Print Pdffiller

Demographics Franklin County Ohio

Auto Title Manual Franklin County Ohio

New Court Order Instructions Franklin County Ohio

Franklin County Treasurer Home

Township Maps Franklin County Engineer S Office

Franklin County Engineer S Office

Franklin County Raising Plate Fees